AI Voice Agents for Insurance Industry

Insurance companies can now use AI technology to handle insurance claims, FAQs, and more.

Smarter Insurance Support

The insurance industry has been the main preventer of financial loss for individuals and organizations for ages, helping people bounce back from life’s unexpected moments.

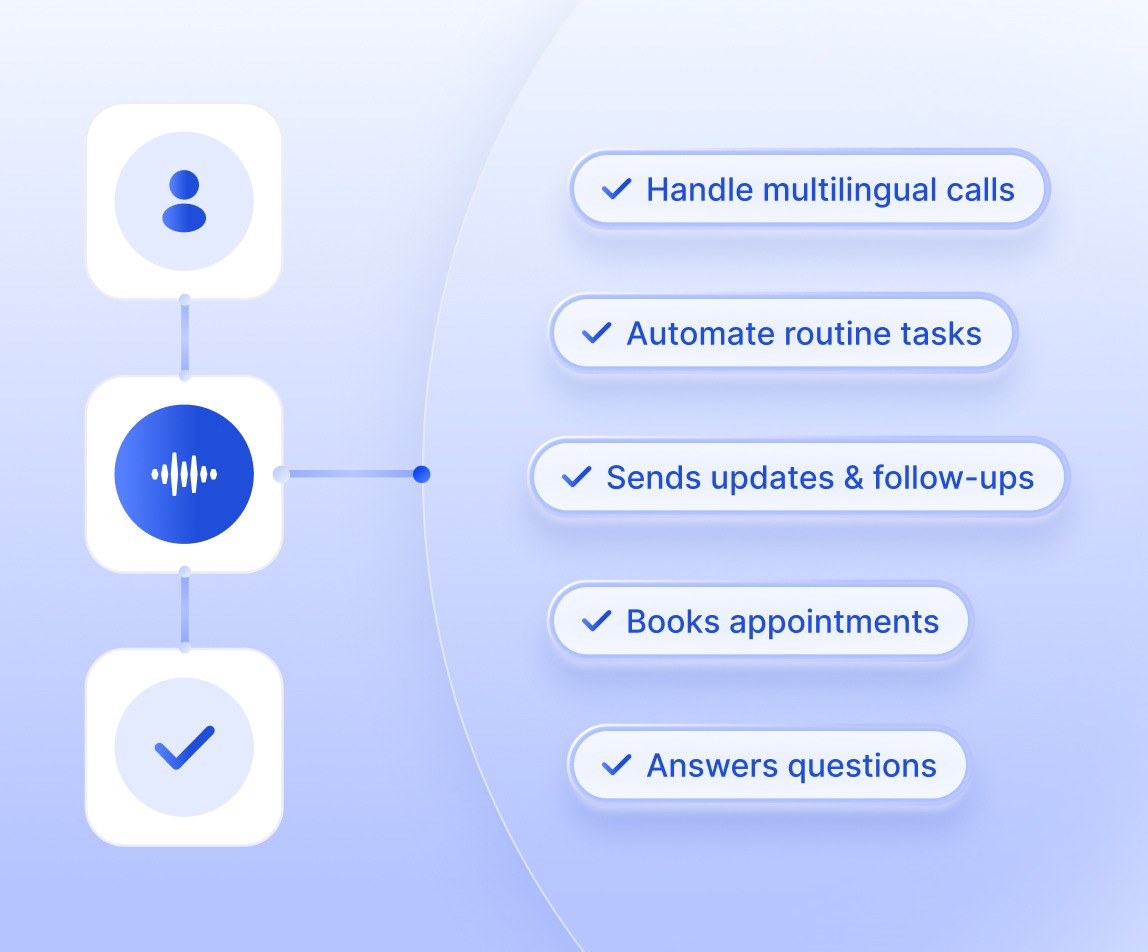

Insurance companies are now choosing AI voice agents to help their customers at any moment, being able to handle routine tasks as the primary line of assistance.

Accurate & Effective AI Voice Agents

Our AI voice agents can have actual conversations with insurers instead of just repeating scripts and dedicate all their time to customers’ needs while learning at the same time.

They use speech recognition and machine learning to understand and respond to different sorts of questions and guide customers when needed.

Benefits

Why Insurance Companies Choose AI

Faster Response Times

An AI voice agent for insurance can give out faster responses and speed up the overall process

24/7 Availability

Insured people might need assistance at unusual hours of the day. 24/7 assistance is important for customer satisfaction

Scalability

Take care of more clients while strictly following the business strategy

Offer a Better Customer Experience in Different Types of Insurance

No matter the type of insurance people have, each customer will not only get help but also feel like the company is giving them the best customer experience.

Car insurance

Home insurance

Life insurance

Health insurance

Travel insurance

Use Cases

Use Cases for AI in Insurance

Automated Claims Processing

By using conversational AI for insurance, claims can be processed faster than before

Fraud Detection

AI insurance agents can ask routine questions and flag anything that feels off

Customer Support

They can help by answering common questions quickly and transferring the call when needed

Risk Assessment

AI voice agents can analyze underwriting data and suggest what kind of coverage makes the most sense

Insurance Agents vs Insurance Artificial Intelligence

Insurance professionals are great at customer engagement and complex parts of the insurance process, offering a human touch. But they can handle only limited large volumes of tasks. AI voice agents, however, quickly manage large volumes of routine work and analyze data to improve responses.

For the short-term future, companies prefer to combine both. AI handles routine policy information and initial customer engagement, letting insurance professionals focus on complex needs.

Frequently Asked Questions

Are AI voice agents AI tools?

Yes, AI voice agents can be considered a type of AI tool. AI tools for insurance agents use machine learning algorithms and also rely on natural language processing (NLP).

What is generative artificial intelligence?

Generative AI is exactly what its name implies. It’s AI that can generate text, audio, or other things that sound or look natural. This is possible by learning patterns from a given dataset.

Is using gen AI technology safe?

Yes, it is safe. AI and insurance can go hand in hand, but just like any technology, the safety depends on how it’s used and the precautions in place.

Can AI replace insurance agents?

This depends on the insurance company and its needs. While AI voice agents and an assigned virtual assistant can help with answering questions, they may lack the empathy or the emotional intelligence needed for more complex situations. Customers might prefer to interact with a real agent when dealing with tricky scenarios.

Can AI voice agents in Insurance help with accessibility?

Yes, they can improve accessibility. Historical data can be used for training so that they are able to reduce human errors and respond in natural human language. Human agents would be able to focus on more complex customer needs because of AI voice agents.

How can artificial intelligence AI improve customer service in insurance?

AI improves customer service in insurance by using new technologies to speed up claims and answer questions quickly. Things like AI car insurance, insurance AI for health, or even an AI insurance company focused on travel services can help make support always available.