Conversational AI for Banks: AI Voice Agents Transforming Customer Support

AI personalized customer support that doesn’t keep anyone waiting for an operator.

Revolutionizing Finance

Financial institutions need reliable support that helps clients 24/7 with any sort of queries. Our AI solution is the perfect thing for that, helping clients with information on loans, account questions, and even financial decisions.

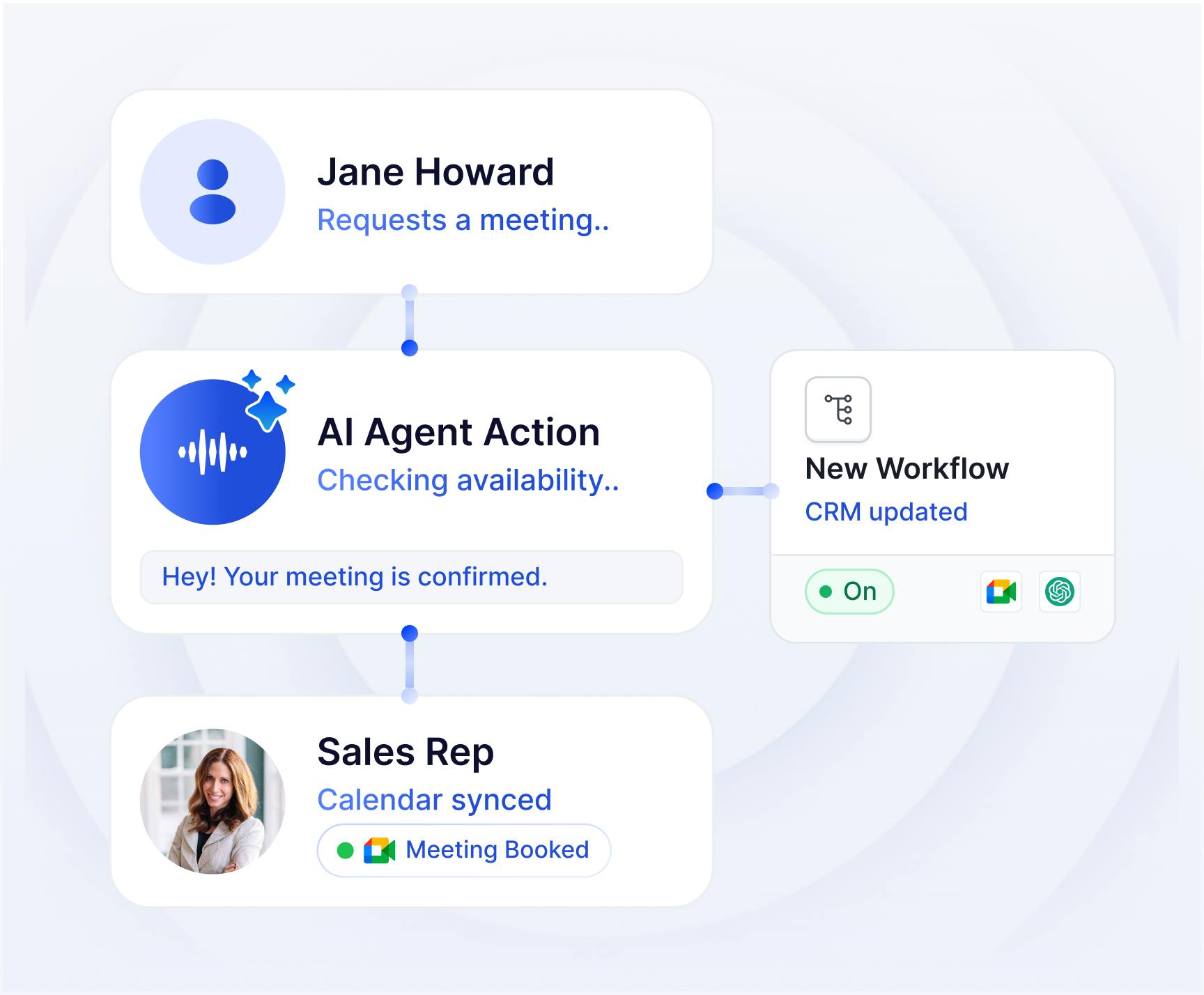

Launch our AI voice agents and see how they handle routine tasks without needing a human agent.

Why Conversational AI for Banks is Perfect for Banking & Finance

Generative AI is important because it helps banks and other financial institutions determine exactly what a customer needs, then provides clear and helpful answers.

This is all possible because our AI voice agents use data, machine learning, and other components to respond in real time like a real person would.

Conversational AI for Banks and Financial Services

AI voice agents are ready to assist customers when they need detailed information or require step-by-step guidance. From identification and account changes to helping them find an ATM, generative AI voice agents are well prepared to help at any time.

And by using our AI service, human intervention will only be needed when tasks become more complex or users demand it

Benefits

Perks of Using a Voice AI Agent

Faster Customer Support

No more long wait times! Customers can get instant responses from AI voice agents.

24/7 Availability

Customer needs can come at any time. An AI voice agent will make sure those needs don’t go unanswered.

Personalized Support

AI voice agents can use previously collected data and give personalized support.

Financial Institutions That Can Benefit from Agentic AI

Banks

Credit Unions

Investment Firms

Insurance Companies

Mortgage Lenders

Wealth Management Services

Fintech Startups

Payment Processing Companies

Brokerage Firms

Microfinance Institutions

Use Cases

Use Cases That Reduce Cost and Grow Revenue

Contact center automation and SLA gains

AI agents resolve routine account inquiries and transaction disputes automatically, handling up to 80% of volume in many deployments. The result is faster SLA compliance and lower seasonal staffing costs.

Personalized guidance and cross-sell

During ordinary service calls the AI identifies lending and investment opportunities and surfaces pre-qualified offers. That turns support interactions into measurable revenue with clear attribution.

Fraud prevention and risk reduction

AI flags inconsistent behavior in real time and routes cases to investigators with detailed conversation context. This reduces manual review time and lowers false positives for faster resolution.

Wealth and advisory support

Voice agents provide timely portfolio updates and basic advisory answers outside advisor hours. That increases client engagement and helps advisors focus on high-value conversations.

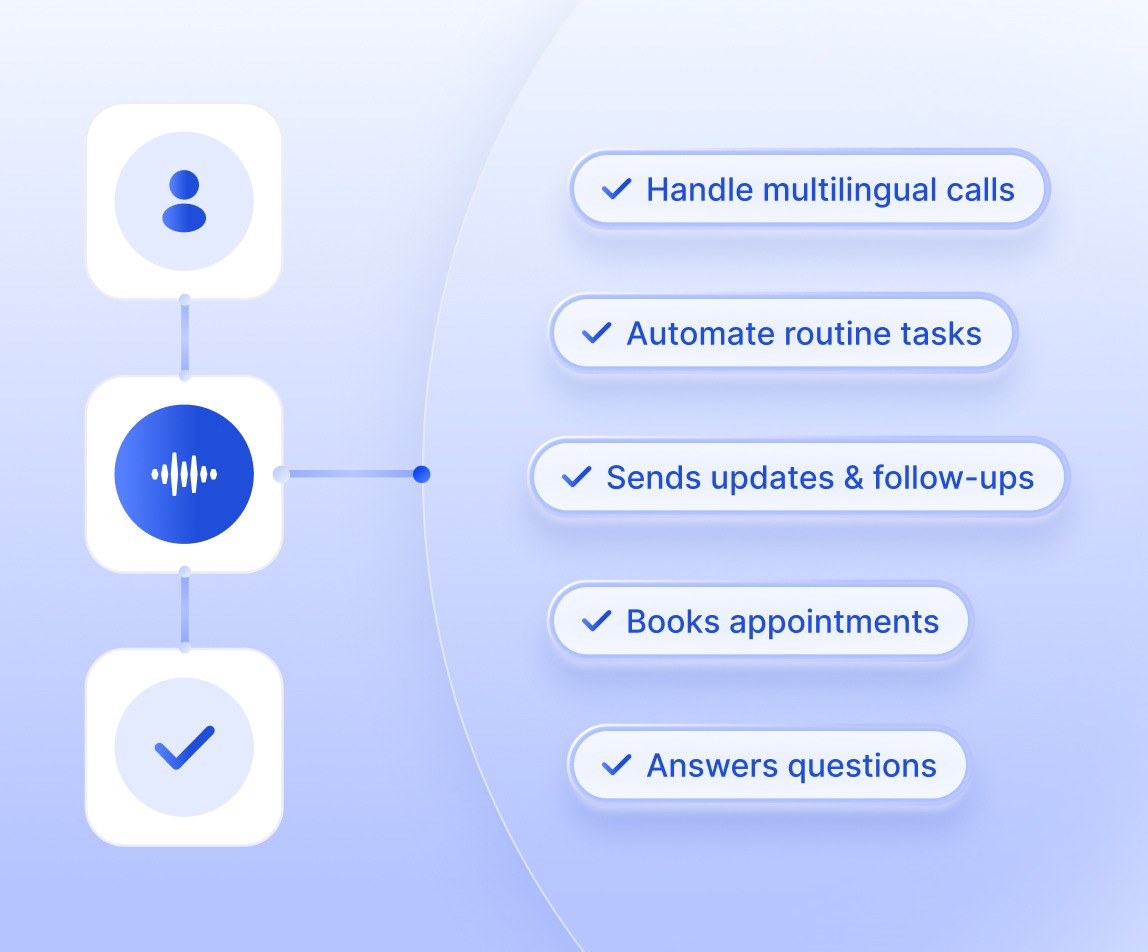

Financial inclusion and multilingual access

Multi-language voice support and accessible interactions make services easier to use for underserved segments. This expands your market reach and strengthens community banking relationships.

A Better Customer Experience

Excellent customer service is vital for any business in banking and finance. Our AI voice agents have the power to handle FAQs and repetitive tasks with human-like quality. This easily accessible solution frees up your team, improving support and making customers happier.

Human Agent vs AI Voice Agent

Agentic AI in finance manages lots of calls and automates complex jobs, but it sometimes gives wrong answers or lacks empathy.

To handle these challenges for various use cases in banking, this AI needs good training, to continuously learn the risk levels, and to go through experimental phases with data analysis to perform well. We make sure you launch good agentic AI from the start.

Easy to deploy

Deploy in Weeks, Not Months

Typical 30-day deployment

Most institutions go live in 30 days with a focused scope: authentication flows, common inquiries, and escalation paths. The staged approach delivers visible SLA improvements in two months while minimizing staff disruption.

Core banking integrations

We connect to major cores like FIS, Fiserv, Jack Henry, and Temenos using native connectors and APIs. That means real-time account reads and action without replacing your existing systems.

Operational handover and training

Our banking success team provides role-based training, playbooks, and a 30-day optimization window. Operations keep control while AI handles routine volume and hands off complex cases with full context.

Monitoring and SLAs

You get live dashboards for resolution rates, average handle time, and conversation quality. We support 99.9% uptime guarantees and configurable SLAs that match your contact center standards.

Compliance

Banking-Grade Security and Audit Controls

Data controls and zero-retention option

We offer zero-retention configurations so sensitive financial data never persists on external servers. That approach supports stringent examination requirements and reduces legal and operational risk.

Standards and certifications

Our platform supports SOC2, PCI-DSS, FFIEC and SOX readiness with audit trails. Compliance officers receive exportable logs and conversation transcripts for examination and reporting.

SOC 2 Type II

SOX

PCI Level 1

On-premise and private cloud choices

For institutions that require full data sovereignty we provide on-premise or private cloud deployments. This gives IT full control while still enabling automated, human-like conversation handling at scale.

Authentication and fraud detection

Built-in multi-factor flows and real-time risk scoring reduce fraud exposure. The AI flags suspicious patterns and seamlessly escalates to fraud teams with complete context and recommended next steps.

Results

Real Banking Results and Case Studies

Results snapshot

A regional bank pilot cut routine handling costs by $3.2M annually and raised first-contact resolution to 85%. The result is predictable savings that support board-level approval and fast operational wins.

Customer success briefs

A credit union reduced average hold time to under three seconds during peak season while keeping exam-ready audit trails. These short briefs show how our banking success team replaces long rollouts with targeted, measurable deployments.

How we measure ROI

We report cost per resolution and revenue attributed to cross-sell in the same dashboard your CFO uses. That lets operations and finance see the same metric and sign off on performance-based contracts quickly.

Frequently Asked Questions

From retail banking to asset management, generative AI and intelligent systems can help all sorts of financial institutions.

What are AI voice agents in banking and finance?

They’re built using large language models and are designed to handle real conversations. AI voice agents are now being considered as part of a bigger paradigm shift in how financial services work. AI voice agents can understand context, follow compliance requirements, and help customers with different queries.

What types of financial institutions can benefit from AI voice agents?

From retail banking to asset management, generative AI and intelligent systems can help all sorts of financial institutions.

How do AI voice agents work in the financial industry?

With artificial intelligence, and in the financial industry, AI voice agents can understand, process, and respond to customer requests without needing human oversight.

What is an example of an agentic AI?

An example of agentic AI is an AI voice agent for finance. One that acts as an orchestration layer, and can be used to automate processes like answering customer questions or processing transactions. When things get too complex, human intervention is brought in.

Can AI voice agents improve asset management?

Yes. Finance AI voice agents can improve asset management teams by processing large amounts of customer data from different sources, tracking performance, and enabling real-time updates. Financial organizations can use this technology as the next frontier, opening a wide space for new capabilities that act as governance tools.

What financial services can AI voice agents work in?

AI voice agents in corporate finance or any other area of it can assist with a wide range of financial services like account inquiries, loan guidance, financial fraud-related queries, payment support, and even investment-related questions. AI voice agents can even reduce manual work in financial crime investigations!

How do AI voice agents for finance support financial inclusion?

Financial inclusion means 24/7 assistance, responding in multiple languages, helping users who may have limited access to traditional banking or have privacy concerns, etc. Talking to an AI voice agent about finance can make it more accessible for anyone around the world. The best part about AI voice agents is that they work in various industries.

Is artificial intelligence important for financial institutions today?

Because it helps financial institutions operate more efficiently. From things like reducing human error to even spotting patterns in customer behavior. Agentic AI finance can now be considered a must-have solution at any financial institution.

Will this replace human agents?

No. AI handles routine volume and hands complex calls to specialists with full context. This lets human teams focus on high-value work while the AI improves routine efficiency and customer response times.

Can AI voice agents be used in mobile apps?

Typically, AI voice agents aren’t used in mobile apps for financial institutions. Instead, AI assistants are used.

How quickly can we go live?

Typical scoped pilots are live in 30 days with core account reads and common inquiry handling. That timeline includes integration, compliance checks, and staff training so you see SLA improvements within two months.

What security and compliance controls are included?

We support SOC2 and PCI-DSS and provide exportable audit trails for FFIEC and SOX examinations. On-premise and zero-retention deployment choices let compliance teams keep full control over data handling.

How does pricing work?

We offer performance-based contracts that charge per resolved conversation and for revenue outcomes. This aligns vendor incentives with your cost reduction and revenue goals for predictable economics.

What integrations are required?

We connect to core banking, CRM, and compliance platforms via APIs and native connectors for FIS, Fiserv, Jack Henry, Temenos, and major CRMs. Integration does not require migrating your core systems.

Is this solution suitable for smaller banks and credit unions?

Yes. We provide white-glove implementations scaled for community banks and credit unions so IT resource needs remain small. The approach preserves local relationship models while adding 24/7 accessible support.

What is conversational ai for banks able to do?

It delivers human-like voice interactions that resolve routine inquiries, support loan workflows, and surface revenue opportunities while maintaining regulatory controls. The platform focuses on measurable outcomes and exam-ready reporting.